Take Advantage of Section 179’s Benefits in 2021

Learn about the updated Section 179 terms for this year.Over the years, we’ve talked a lot about Section 179 and how it can benefit your business during tax season. We’re happy to announce that the maximum dollar amounts have once again increased from the previous year.

What is Section 179?

For those who may not know, Section 179 allows businesses to deduct the full purchase price of qualifying equipment that was purchased or financed during the tax year. Section 179 is unique as a government incentive that was created specifically to benefit small businesses. At Oakmont Capital Services, it’s crucial to us that small businesses are able to take advantage of any opportunities that can benefit their bottom line. That’s why we recommend utilizing Section 179.

Section 179 Benefits

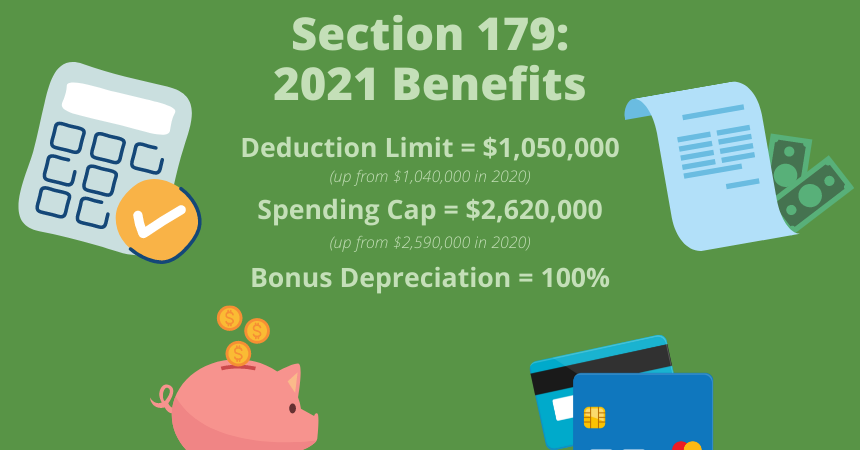

Here’s a quick overview of Section 179’s benefits for 2021:

With the promise of more immediate tax savings and increased cash flow, it’s important that you take the time now to consider potential equipment purchases before the year ends. Taking advantage of Section 179’s perks means that you are able to grow your business by investing in yourself.

Oakmont Capital Services is here for our customers. We offer*:

- No Money Down

- E-Docs + Remote Online Notary

- Structured Terms for Troubled Credit

- Standard Rate Financing

- Delayed and Seasonal Payment Options

*Terms based on credit approval

If you’re looking for more information about Section 179, or are looking to work with Oakmont Capital Services, feel free to reach out at any time: ocs@oakmontfinance.com or 877-701-2391.

WHY CHOOSE US?

Better Rates and Flexible Terms

Oakmont Capital shatters the big bank rates, making us the go-to funding source for a wide range of customers.

Over 20 Years of Experience

Work with our team of experts and grow your business. Speak with our Certified Lease & Finance Professionals today to learn more.

24 Hour Turnaround

Our streamlined application process delivers credit decisions within hours, not days, maximizing your time and experience.