Women in Leadership and Equipment Finance at Oakmont Capital Services

“I also cannot forget to acknowledge the women that paved the way before me to allow women to have a voice and successful careers in our society. There is much more work to be done, but we can all carry the torch and lift others up to continue to move in the right direction.“

– Kayla Perlinger, CLFP & VP Syndications

Diversity, equity, and inclusion are crucial for any organization to thrive. According to Forbes and a recent LinkedIn article, workplaces that embrace and employ diverse team members see increased levels of productivity, collaboration amongst coworkers, and a higher level of interest from prospective job candidates.

The leasing and loan sector is an emerging champion of this initiative. The Equipment Leasing and Finance Association (or ELFA), for example, not only has an ELFA Equality Committee focused on fostering an inclusive environment, but they’ve created a tool kit that fellow industry professionals can defer to as a guide on best practices. In November 2022, they also held the industry’s first Equity Forum in D.C.

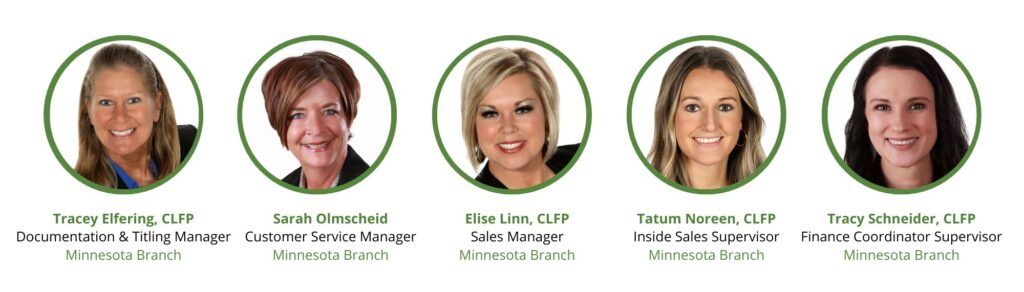

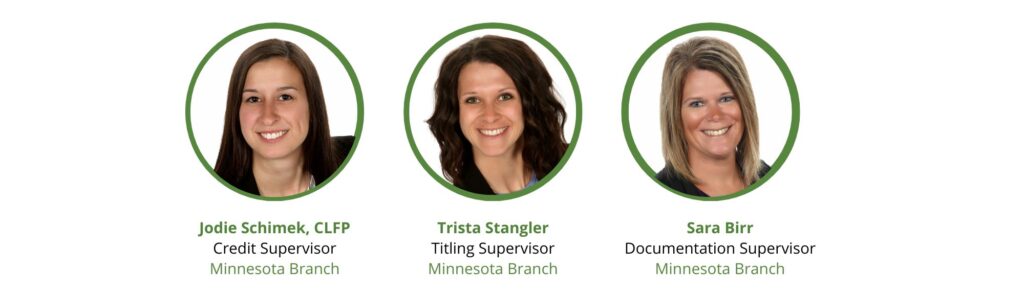

Oakmont Capital Services is proud to have 13 female finance professionals serving in leadership roles throughout the organization. Their varying perspectives, industry experiences, and more have contributed to the success of their teams.

These 13 leaders include:

- Megan Zoba, OCS Founder and VP Documentation & Funding

- Kayla Perlinger, CLFP and VP Syndications

- Mikki Henkelman, CLFP and VP Credit & Risk

- Keara M Piekanski, MBA and Director of Marketing

- Tracey Elfering, CLFP and Documentation & Titling Manager

- Jen Foulds, CLFP and Funding Manager

- Sarah Olmscheid, Customer Service Manager

- Elise Linn, CLFP and Sales Manager

- Tatum Noreen, CLFP and Inside Sales Manager

- Tracy Schneider, CLFP and Finance Coordinator Supervisor

- Jodie Schimek, CLFP and Credit Supervisor

- Trista Stangler, Titling Supervisor

- Sara Birr, Documentation Supervisor

We sat down for a round table discussion where they each shared their experiences in the equipment finance industry, at OCS, and as a woman in the workplace. We asked the tough questions (and a few fun ones) with the hope of understanding their perspectives, in addition to gleaning guidance for up-and-coming professionals. Enjoy!

Q&A with Oakmont Capital Services’ Women in Leadership

Q: How long have you worked in the equipment finance industry?

Linn: I’ve been in the industry for 22 years.

Olmscheid: 23 years for me.

Elfering: Me, too!

Foulds: Just over 12 years.

Perlinger: 11 years.

Birr: It will be 11 years for me, too, this year.

Stangler: 10 years.

Piekanski: Just over 4 years.

Schneider: I started in 2015, so not quite 8 years.

Noreen: I have been in the industry for 7.5 years.

Zoba: 31 years.

Schimek: 2 years for me.

Henkelman: Megan wins! This is only my 16th year in the industry (yes, I started when I was just a baby!).

Q: How did you each get your start in the industry?

Elfering: I randomly stopped at a local Albany bank to fill out a job application. I was given an interview on the spot and was hired that day (and have LOVED the leasing world ever since).

Henkelman: I also stumbled into it – after college – but I’ve been fortunate to stay since. We always joke that it is an industry that once you’re in, you just can’t (or don’t want to?) leave!

Schimek: OCS had an opening. I had experience as a credit analyst but not in the equipment finance industry. I thought I would take a chance. Once I was in, I was hooked.

Q: What roles have you had during your career?

Perlinger: I’ve been a Credit Analyst, Syndication Analyst, Sales Analyst, Broker Relations Supervisor, Syndications Manager, and now, VP of Syndications.

Piekanski: I started on the bottom of the advertising/marketing ladder as a Marketing Coordinator, was promoted to a Junior Marketing Account Executive, then a Marketing Account Executive, and a Marketing Manager. I also served as a Director of Product Development for service-based initiatives before assuming my current role as Director of Marketing. I’ve worked in both agency and corporate environments on B2B and B2C strategies and tactics.

Henkelman: I have always been focused on the credit side of things, or as people say, the “good” side. This includes underwriting, portfolio, compliance & risk.

Stangler: I started in Reception, and then I moved to Customer Service. I would help in Accounts Receivable sometimes before I was moved to Funding. That’s where I was before I came to OCS. When I started at Oakmont 2.5 years ago, I began in Titling and have stayed there since.

Birr: During my career in the industry, I started as a Sales Assistant and then became a Documentation Specialist, which led me to a supervisor position.

Olmscheid: Funding, Documentation, Insurance, Titling, and Customer Service. Specifically, I started as a Funding Specialist and then moved to a team lead in funding which led me to Funding Manager. At one time I was the Operations Manager overseeing Funding, Docs, Insurance, and Titling.

Noreen: I started my career as a credit analyst and then transitioned to sales. Within the sales role, I’ve been a team leader, had the opportunity to create a team and its processes, and am now a supervisor.

Q: What challenges have you faced as professional career women?

Linn: For me, it’s been proving to be relevant in this industry. Proving your knowledge, not only of the product you’re selling but also knowledge of the equipment you’re financing. Competition in this industry is fierce so solidifying the relationships and making sure they’re going to stand the test of time is a challenge.

Piekanski: I couldn’t agree more, Elise. I think there’s always an expectation of proving yourself repeatedly. Perhaps it’s self-imposed, but with every role I’ve taken on, I’ve felt the need to over-deliver to show my value.

Foulds: It’s interesting how you both have experienced that because I do see a lot of respect for women, and I believe that is a compliment to the up-and-coming individuals in the industry. There is an open-mindedness and a diversity-positive attitude.

Schneider: Absolutely. I think a lot of great women have paved the way to balance the scales and I feel I have been fortunate to work with some great leaders who don’t see gender but see potential.

Zoba: The biggest challenge for me was/is keeping a healthy home and work-life balance.

Birr: That’s my biggest challenge, too.

Perlinger: Agreed! Having children and contributing to the support of the family, as well as growing a career, can come with many challenges. Being a mom can bring ‘mom guilt’ for spending time away from children (though men can have dad guilt, too). I also was afraid that time away from work would lead to delayed or completely missed opportunities. I feared not being able to give 100% to each area of my life, and it has taken time to find a place to be successful in each.

Henkelman: Me, too, Kayla.

Perlinger: Beyond this, I have been fortunate as I have not had many direct challenges in my career due to being a woman in a professional setting. I have been surrounded by both women and men that have encouraged and supported my growth throughout the years. Though, at times I felt intimidated (mostly in prior years) when I would walk into a conference that was dominated by all middle-aged men. However, when I began to speak with them, I realized that they were very much willing to share knowledge, ideas, and experiences. I do think that gender bias and true challenges for women exist in our society, and I contribute much of my success to hard work, the support of my mentors and sponsors, and my willingness and determination to speak my mind in a room no matter the gender. I also cannot forget to acknowledge the women that paved the way before me to allow women to have a voice and successful careers in our society. There is much more work to be done, but we can all carry the torch and lift others up to continue to move in the right direction. Men are important to this path too, as they continue to take on more responsibilities within the home, take time away from work for childrearing activities, and acknowledge and promote women’s success and growth when earned.

Q: What has your journey been like? Any obstacles that others should avoid (if they can) or advice you can offer?

Elfering: Personally, I’ve had a great journey, but I would remind other women that they need to focus on a suitable work/life balance like my colleagues mentioned above. Your children will only be their current age, once. Treasure that time with them (and if you have a great employer, they will understand this, too!)

Schneider: My journey has been full of ups and downs (thankfully mostly ups!). I think I have a long way to go in my career, but I will say; trust your instincts and find something you love to do and somewhere you love to work – it makes it all worth it.

Henkelman: I have been very fortunate to have a great employer! I think the best advice I can give is to not let people box you in. Allow yourself the option to grow in a variety of areas. Additional knowledge will not only help you but your company. Talk about a win-win! Also, don’t make assumptions that others know what you want. If you have an interest in learning something, ask. It may take time, but if you don’t speak up for yourself, the opportunity may pass you by.

Foulds: You took what I was going to say, Mikki!

Perlinger: I also encourage continuing education and becoming informed on diverse topics.

Zoba: As with any career path, you will have your highs and lows. Make sure the people you choose to partner with have the same goals and ethics. When something sounds too good to be true it typically is.

Birr: Megan’s right. Your journey will most likely come with ups and downs but hopefully more ups. Love your job. Love your company. Understand at the end of the day, the company is a business and will operate as such. Make decisions that are best for you and your overall health and happiness.

Piekanski: I was just going to say something similar to Megan, too! Surround yourself with other women (and men) who are your champions, will support you, advise you, acknowledge you, praise you, and say your name in a room where it matters.

Olmscheid: My advice? Always be available to your team. They should be able to depend on you to help them through any issues that arise.

Linn: This industry is ever changing so you have to be ready to pivot and adjust quickly!

Q: Did you have a mentor early on in your career? If so, how did they impact you? What are the benefits of having one if you did?

Zoba: I did not have a formal mentor, but I once worked for a woman who, at the time (and in a heavily male-dominated field) was quite successful and very well respected. I learned a lot from her.

Elfering: My ‘mentor’ was informal, too. That person taught me that hard work and dedication would reap great rewards. I still try to live by this each and every day.

Henkelman: Knowing that someone else believes in you is a very powerful and motivating thing. I have tried to absorb as much as I can from the people around me, both at OCS and within the industry.

Linn: There were a couple of mentors along the way for me, and honestly, I still have peers that I think of as mentors. Although I have been in the industry for many years, I learn something new every day. I learned so many of my sales skills, industry knowledge and management skills from my mentors.

Foulds: Megan Zoba taught me everything I know. I am honored to have been her second in command for this many years.

Q: Are you currently a mentor?

Perlinger: I think most people can mentor without the formality of the label. Beyond mentorship, I think it is important to be a sponsor to someone and truly advocate for their success and promotion. I have had true sponsors in my career that have believed in me, and I think it’s important to continue to lift others up along with us.

Piekanski: You really hit the nail on the head, Kayla. I’m not formally mentoring at this time, but I do offer mentorship to a former direct report who is also a friend.

Q: What organizations, associations, or groups can you recommend for our readers (industry-specific or other)?

Elfering: I was recently asked by a college student if they should become involved with DECA (Distributive Education Clubs of America) and of course, I said yes. I was part of this club back when I was in college and learned so much.

Henkelman: Personally, I am a huge advocate for the CLFP Foundation. Regardless of your time in the industry (there is an associate designation available! *wink wink*), department, or experience level, it is so valuable to get a better – or different – understanding of our overall industry. As the saying goes, you don’t know what you don’t know.

Piekanski: The Equipment Leasing and Financing Association is a great one, along with the CLFP.

Zoba: I second the ELFA.

Foulds: And don’t be afraid to reach out to recent connections made in real life through LinkedIn. They can become great resources.

Perlinger: I served as a member of the National Equipment Finance Association’s (or NEFA) Chris Walker Education Fund committee for several years, which provides grants for educational opportunities in our industry. I have also been involved with the St. Cloud Zonta Club which is part of an international organization whose primary focus is improving the status of women worldwide. Being a part of associations or groups provides invaluable career and personal growth opportunities. I recommend getting involved!

Linn: I think it’s important to be involved in the industries you work in such as construction, tree care, optical etc. For example, in construction, there is the Associated Equipment Distributors (AED) and American Rental Association (ARA). In tree care, there is Tree Care Industry Association (TCIA). Anything that can keep you abreast regarding industry news, trends and data is excellent.

Q: What’s the best piece of advice you’ve been given?

Elfering: “If you love what you do, you will never work a day in your life.” SO TRUE!!

Henkelman: “Continue learning and don’t be afraid to fail. Some of the greatest lessons are learned while you pick yourself up.”

Stangler: “If you can dream it, you can do it.” – Walt Disney

Linn: Two things: “Think like an owner” and “See a situation from all sides.”

Birr: “View every person you meet as a door that may lead you to a new opportunity.”

Noreen: “You miss 100% of the shots you don’t take.”

Schneider: “Be a fountain, not a drain.”

Schimek: “Everything happens for a reason. Follow your gut.”

Foulds: “Better to ask for forgiveness than permission”– Admiral Grace Hopper via OCS’ COO, Daryn Lecy.

Q: What advice would you give to other women who are looking to pursue leadership roles?

Olmscheid: Always lead by example.

Birr: Trust your own talents and abilities, work hard, enjoy the journey, and don’t forget to celebrate your successes.

Perlinger: Education should never stop, and we all need to continue to learn and grow. Once you are ready for additional opportunities, have a respectful conversation with someone that is willing to advocate for you and capable of assisting in your career growth. Ask what you can do to take on additional responsibilities and communicate your interest in a leadership role. Be bold and honest, but make sure your hard work is continuing to prove your capabilities.

Piekanski: Find an organization where your value will be appreciated, where you can truly have a seat at the table, make an impact, and shine. You being you should be enough.

Schneider: Ditto, Keara. Work hard for those who see your value and if your value isn’t seen, find somewhere where it will be.

Q: What do you enjoy most about working at Oakmont Capital Services?

Olmscheid, Elfering, Foulds, Zoba, Schneider, Birr, Schimek and Henkelman: The people (jinx!)

Linn: Our team.

Perlinger and Stangler: The culture.

Piekanski: The family-friendly environment.

Noreen: Everything.

Women in Leadership and Equipment Financing Recap

Oakmont Capital Services is an example of how the leasing and financing industry has embraced equity. Equipment finance companies and industry associations/organizations are initiating conversations that, at first, may be difficult but are changing our industry for the better – helping employees advance their careers and feel safe and welcome in the workplace. Employees are at the core of every successful organization, and OCS is no exception. As a woman and newbie in the finance sector, I (a.k.a. the interviewer) was fortunate enough to organize this discussion and obtain honest input from my colleagues. I learned about several industry opportunities that can foster growth and valuable advice that I will keep in my back pocket. More importantly, however, if I feel doubtful or discouraged at any point, I can remind myself that a path has been forged by female professionals who came before me. Women in the workplace have faced and overcome various obstacles, and should I ever need to, they’re just an email/phone call away. Representation matters, and although we still have work to do in our organization and industry-wide, it’s a good place to be today!

By Ana Suarez, Marketing Communications Specialist

Oakmont Capital Services (OCS), founded in 1998, is a direct, independent lender providing commercial equipment financing and working capital throughout all 50 United States. Our seasoned finance professionals work across many industry verticals, helping customers secure funding quickly and easily via a streamlined, virtual process. Our rates and terms are affordable, making OCS a reputable solution for equipment financing. The professional financing staff at Oakmont is the reliable choice for today’s financing needs. For more information, visit www.oakmontfinance.com.

WHY CHOOSE US?

Better Rates and Flexible Terms

Over 20 Years of Experience

24 Hour Turnaround